JAUST™

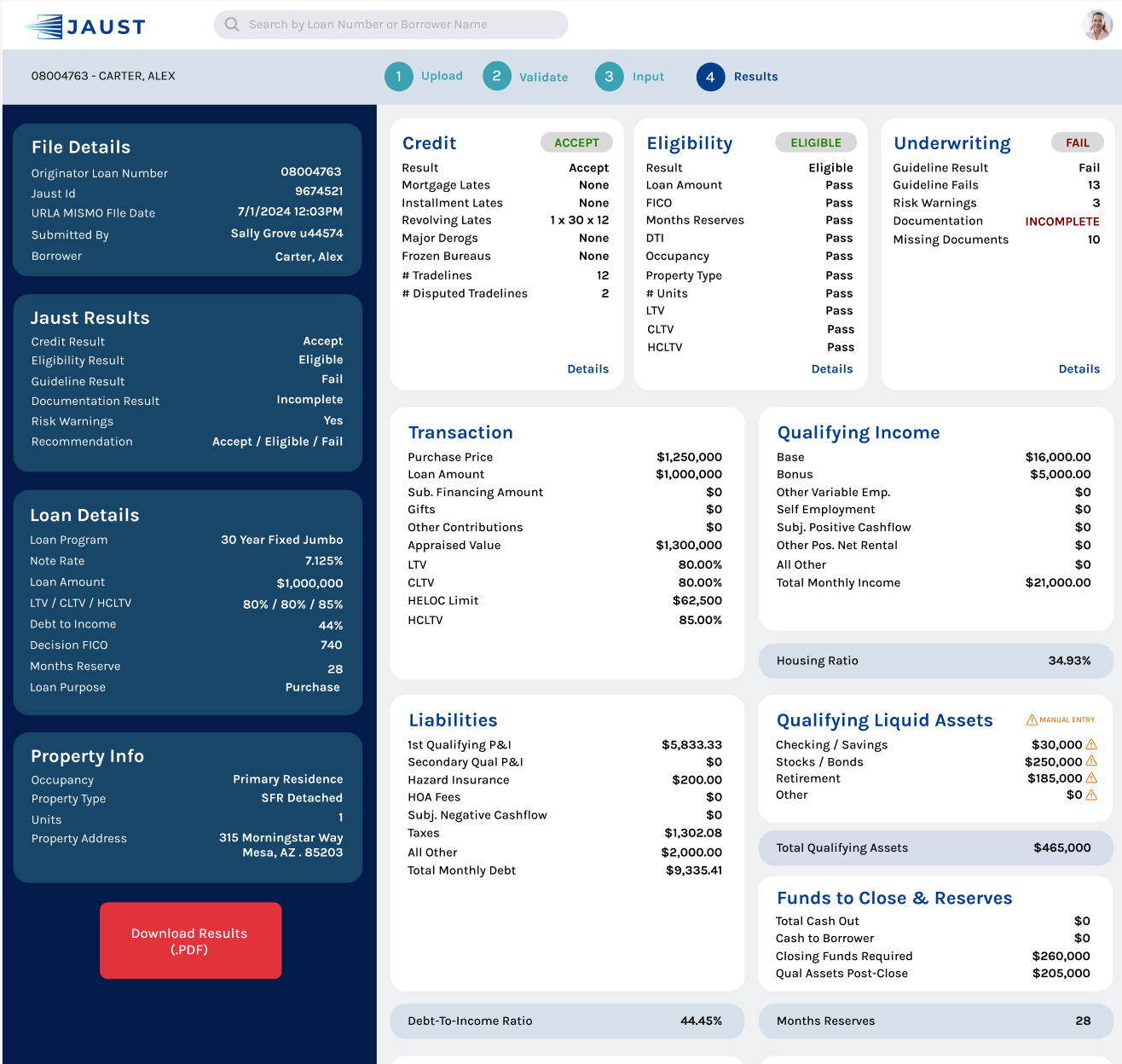

JAUST™ is an automated underwriting system that provides lenders greater certainty in jumbo originations and offers borrowers faster final decisions. Our solution spans all conventional first mortgage originations; focused on the non-conforming, non-QM space as well as Home Equity and other types of secondary financing.

The system classifies and extracts data from more than 50 document types and applies the full breadth of a lender’s eligibility, pricing, credit, documentation and all underwriting guidelines, to provide a detailed recommendation.

JAUST™ is designed to reduce origination costs and provide lenders access to a network of investors eager to expand their businesses in a highly competitive market.

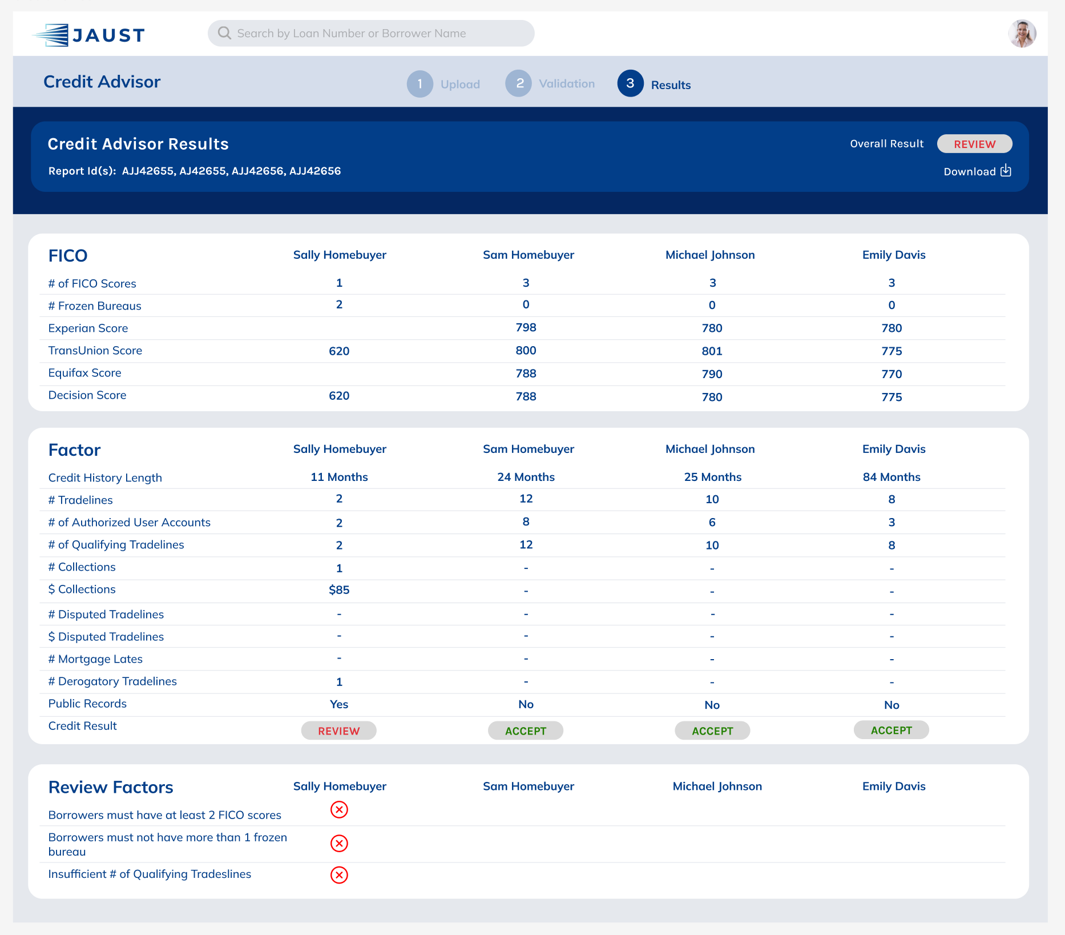

Credit Advisor

Credit Advisor is a stand-alone Credit Decisioning model that evaluates up to 2 joint or 4 individual tri-merge credit reports against a selected investor’s requirements for length of credit history, minimum number of tradelines, status, recency of activity, derogatory information, balances and public records. CA allows for adjustments based on the presence, recency and nature of disputed tradelines, Authorized User accounts and frozen credit bureaus. CA returns an Accept or Review result. Up to 50 credit policies are supported.

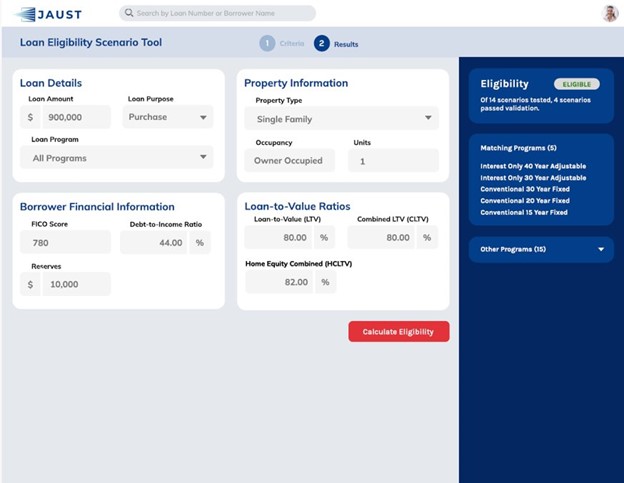

Program Advisor

Program Advisor (“PA”) is a stand-alone Eligibility model that evaluates the requested loan amount, LTV, CLTV, HCLTV, FICO, Reserves, DTI, Loan Purpose, Occupancy, Property Type and Units across as many as 100 investors and 50 loan programs per investor. PA returns an Eligible or Ineligible result for each investor’s loan programs.